The Usage Of The Electronic Signature Device ( part I )

1.Introduction

Some countries Revenue Authority has implemented the Tax Invoice Management System that requires every taxpayer registered for Value Added Tax (VAT), Tourism Levy and Insurance Premium Levy to use Electronic Fiscal Devices (EFD) to record and transmit sales transaction data to Authority. Electronic Fiscal Devices are a wide variety of technological devices and software being used by the Authority to help monitor business transactions.

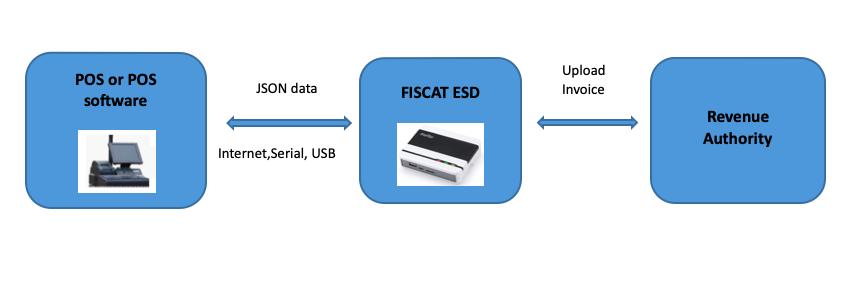

The Electronic Signature Device (ESD) is one such device being implemented to interface existing taxpayer Point-of-Sale (POS) systems with the Tax Invoice Management System hosted by the Authority. It's easy to operate and high compatibility can supports variety of POS systems.

2.Purpose

This instruction describes the technical implementation details of the interface between ESD and POS. It contains the protocol specification and functions that should be implemented on existing or new POS systems to enable them interface with the National Tax Invoice Management System using Electronic Signature Device (ESD).

It can be used as a guideline for POS vender engineer to modify the firmware so as to interface with the Authority's System.

3.Technical standards

The communication data packet between POS and ESD should follow these data format standards

JSON based data format

The data package should be transmitted by TCP/IP or RS232 Serial protocol

CRC (Cyclic Redundancy Check) is used in order to verify the data package integrity

No encryption was used in the protocol

3.1 High-Level Requirements

This section describes high-level requirements for POS terminal.

1.ESD will be initialized first by a registration code to get the tax information form Authority. Registration code and utility for initializing the device shall be provided

2.POS must synchronize the tax information with ESD using the ESD Get Status command.

3.POS must set tax categories for each entry in transaction according to the tax information received from ESD

4.POS should connect to the ESD by Ethernet or RS232 Serial port

5.POS must send transaction information to ESD for tax calculation, signing and uploading on to the Authority Tax Invoice Management System

6.POS must get invoice code, invoice number, terminal ID, final total amount and fiscal code from ESD after invoice signing process and print them on the receipt

7.POS should get the QR code generated by the ESD and print it on the receipt (optional)

8.The tax calculation process is done on the ESD and the total amount should be printed on receipt as final amount

9.The POS shall not complete the transaction without ESD signing process

3.2 Overall

In general, ESD is a middleware between POS and Authority system. It will realize invoice management and tax calculation for POS system. Fiscal code generation will also be done by the ESD. The Sign Invoice command simplifies customization by encapsulates a lot of functions as shown below.

ESD will generate fiscal code for each transaction and save invoice data on the local drive in an encrypted format. The device then immediately uploads the saved data onto the Authority system using the Internet. Invoice signing process.

The invoice signing function is the main process in ESD which will generate many essential components of receipt fiscalization.