The Usage Of The Electronic Signature Device ( part II )

ESD Invoice Signing steps

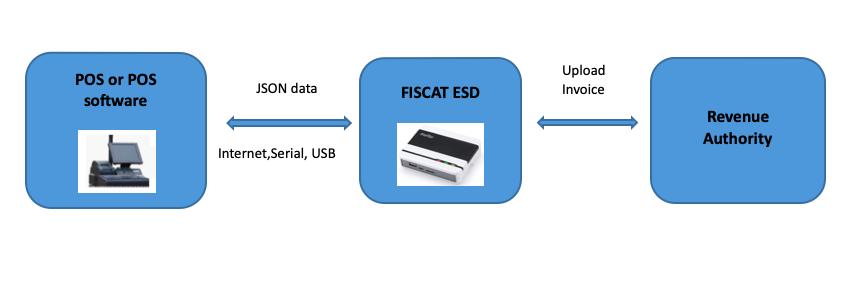

1.POS sends transaction data to ESD for signing

2.Verify the tax categories of items according the tax information saved in ESD

3.Allocate an E-invoice number which is a combination of invoice code and number

4.Calculate the tax amount for each items by the tax categories applied on it

5.Generate fiscal code in ESD by invoice code, number, issue time, and private key

6.Generate URL for verification in ESD

7.Generate QR code of verification URL in ESD

8.ESD responds with invoice code, number, terminal ID, fiscal code and total tax amount , as well as QR code

9.POS prints the tax information on receipt

10.ESD will upload invoice data to ZRA system by network

ESD Invoice Key features

The Invoice must have the following key features:

Taxpayer TPIN

Taxpayer Name

Taxpayer Address

Transaction Time (ESD Time)

Invoice Code

Invoice Number

Terminal ID

Fiscal Code

Functional Requirements

ESD must be initialized first to get the tax information and private key. (Private key is used by the ESD to encrypt data during transmission). During the initialization process, ESD will obtain from the Authority system, the invoice range, tax labels, TPIN, tax account and taxpayers address as well as tax monitoring information. This information will be transmitted to POS in Get Status command. A unique registration code provided by Authority is used in the initialization process for the ESD.

The ESD device provides ethernet port serial communication ports for data transmission.

ESD provide two connection modes which are Ethernet and serial. For serial connection, two serial ports include (USB to TTL) and RS232 are supported. The POS system should set the right port for communication before transaction data transmission. For Ethernet connection, the ESD must get IP address by assistant tool which provide static IP and DHCP mode.

3G module on the device may also be used for communication with Authority system Get ESD status

POS should get tax labels and taxpayers information from ESD using the Get Status command. Then the tax labels can be used for setting tax categories for goods or services in the POS. Get ESD status command should be executed once the ESD is switched on. This way, the POS is able to get the basic status of ESD. (lock status, initialized status, etc.)

POS must send each transaction data to ESD for the invoice signing process. ESD will respond with invoice code, invoice number, TPIN, terminal ID, fiscal code and final total amount, as well as QR code for invoice verification. POS shall not issue an invoice without ESD connection as there will be no fiscal information added on the receipts. The total amount maybe changed because ESD will calculate tax amount according to tax labels applied on each item.

Development Environment

Access to both the Test ESD Gadget and the Tax Invoice Management System development environment is available and granted on request from the Taxpayer or POS Vendor..

For more functions and requirements, please refer to local fiscal law documents!